Strifor

Why Strifor’s Claims Are Empty Air

What if I told you that Strifor operates in a regulatory vacuum so complete it would make a ghost town look bustling? The truth about their regulatory status is more alarming than most investors realize.

The International Red Flags

The International Organization of Securities Commissions (IOSCO) maintains Strifor in their monitoring database under reference 36730. While this might sound like bureaucratic paperwork, in financial circles it’s equivalent to being on an international watchlist. Think of it as financial Interpol having your photo in their files. Spain’s National Securities Market Commission (CNMV) went even further, issuing explicit warning 4968 stating Strifor lacks authorization to operate. But here’s what’s truly frightening: these warnings are like fire alarms in an empty building – they’re sounding, but nobody’s responding.

The Three Pillars of Financial Protection That Don’t Exist with Strifor:

- No Fund Segregation: Your money isn’t kept in separate, protected accounts. It’s mixed with operational funds, meaning if Strifor decides to vanish tomorrow, your money vanishes with them.

- Zero Dispute Resolution: When (not if) you have problems, there’s no independent authority to appeal to. You’re at the mercy of the same people taking your money.

- No Compensation Schemes: Legitimate brokers participate in investor protection programs. With Strifor, if they collapse or disappear, you get nothing.

The Psychology of Entrapment: How Strifor’s Systems Are Designed to Captivate and Capture

The Strifor trading platform isn’t just software – it’s a psychological trap dressed in MetaTrader’s clothing. The entire user experience is engineered to create false confidence and dependency.

The Account Ladder Illusion

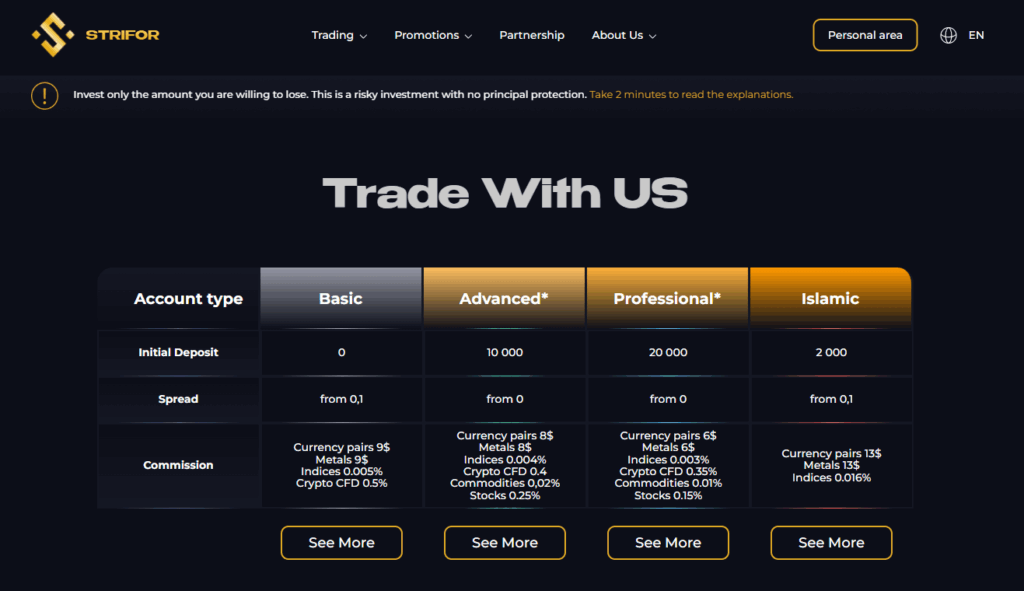

Examining the Strifor account types reveals a carefully crafted hierarchy designed to make you feel like you’re climbing toward success while actually descending into financial quicksand. The absurdly low Strifor minimum deposit isn’t about accessibility – it’s the financial equivalent of a drug dealer giving out free samples.

The Leverage Illusion

The outrageous Strifor leverage offerings (up to 1:1000) represent one of the most dangerous financial instruments ever created for retail traders. In practical terms, this means normal market fluctuations can obliterate your entire account in minutes. It’s like giving a kindergarten class flamethrowers and calling it “educational tools.”

The Withdrawal Black Hole: Where Money and Hope Disappear

The most consistent pattern across all Strifor real reviews is the systematic and deliberate prevention of withdrawals. This isn’t poor service – it’s calculated financial imprisonment.

The Three-Act Tragedy of Strifor Withdrawals:

Act I: The Confidence Game

Small withdrawals process smoothly. This is deliberate psychological manipulation – they’re building trust before the real theft begins.

Act II: The Bait and Switch

Once your account reaches a certain threshold or you request a substantial withdrawal, the rules change. This is when you discover the brutal truth: Strifor does not pay successful traders.

Act III: The Infinite Loop

You enter a maze of verification requests, technical “glitches,” and sudden accusations of terms violations. The Strifor withdrawal issues become your new reality – an endless digital purgatory where your money is always just out of reach. Sarah described her experience: “I provided every document they asked for, including things that felt invasive and unnecessary. Each time I thought I’d jumped through their final hoop, they’d invent a new requirement. After four months, I realized they were just running out the clock until I gave up.”

The Social Engineering Masterclass

All about the Strifor affiliate program

The Strifor copy trading system and Strifor affiliate program represent some of the most sophisticated psychological manipulation I’ve encountered in financial services.

The copy trading feature creates an illusion of community and shared success. However, multiple investigations suggest the “successful traders” are either completely fictional or are executing strategies designed to generate maximum commissions while guaranteeing eventual failure. The affiliate program is particularly insidious – it turns victims into recruiters. One former user told me: “I felt so guilty when I realized I’d brought friends into this nightmare. The commissions they paid me felt like blood money once I understood what was really happening.”

The Human Cost: Beyond Financial Loss

devastation that go far beyond monetary loss:

- A young couple lost their wedding fund and called off their marriage

- A family lost their home down payment and now face eviction

- Multiple victims report severe depression and anxiety disorders following their experiences

The phrase “Strifor cheated me” appears with heartbreaking frequency, but it doesn’t capture the full scope of the damage. This isn’t just financial fraud – it’s the systematic destruction of dreams and stability.

The Business Model of Deception

When you analyze Strifor’s operations objectively, the pattern that emerges is a textbook Strifor fake broker operation:

- The Illusion: Create a professional facade using familiar tools and terminology

- The Hook: Use psychological triggers to establish trust and dependency

- The Capture: Systematically prevent access to funds while maintaining the illusion of legitimacy

- The Expansion: Use social proof and affiliate systems to continuously recruit new victims

The Strifor complaint process isn’t designed to resolve issues – it’s engineered to exhaust victims into submission through bureaucratic nightmares and false promises.

The Refund Fantasy

The desperate search for a Strifor refund is perhaps the saddest part of this entire story. Without regulatory protection or legal leverage, recovering funds from an offshore operation is virtually impossible.

One victim spent $18,000 on international legal fees trying to recover $32,000. The result? The lawyers got paid, Strifor kept the money, and the victim was left with more debt and deeper despair.

The Inescapable Conclusion

After months of investigation, analyzing regulatory warnings, and speaking with dozens of victims, the conclusion is unavoidable: Strifor represents everything that’s wrong with unregulated financial services.

The professional website, the familiar platform, the seemingly transparent Strifor account types – they’re all components of an elaborate digital Potemkin village designed to hide the brutal truth: you’re not investing, you’re donating your money to criminals.

The Strifor withdrawal problem isn’t a bug in their system – it is their system. The Strifor fraud operation depends on taking deposits while preventing withdrawals.

Don’t become another cautionary tale. Don’t let your story become another Strifor scam review that warns others too late. Your financial security is too precious to trust to an operation that multiple international regulators have flagged as dangerous.

Choose transparency, regulation. Choose brokers who are accountable to financial authorities. But whatever path you choose, understand this: engaging with Strifor isn’t investing – it’s volunteering for financial destruction.

Please sign in to your account to leave a review.